Why Are Telemedicine Providers Categorized As High-Risk Merchant?

Telemedicine has become a great option for people who are on the go or farther away from their physician of choice. Because telemedicine is digital, this can be a convenient way for people to receive medical advice and services without having to leave their homes. Unfortunately, telemedicine providers are considered high-risk merchants. This comes with a few drawbacks, particularly in the payment processing area. What is telemedicine? Why are telemedicine providers considered high-risk merchants? What can you do for your telemedicine business when it comes to payment processing? Let’s find out now. What is Telemedicine? Telemedicine involves providing medical diagnosing and other services through technology. This can involve communicating through web cameras, applications, phone calls, and other forms. Of course, there are regulations in place for this industry. However, telemedicine is appealing because patients can connect with their physicians instantly without having to leave their homes. Some of the services provided through telemedicine include: Telemedicine can strengthen doctor-patient relationships without having to meet in a clinic or private practice. Why are Telemedicine Providers Considered High-Risk Merchants? Because the telemedicine industry has grown vastly, so has the number of participants, and ultimately the risks associated with this industry. Telemedicine providers are considered high-risk merchants because telemedicine has a higher number of chargebacks compared to other industries. A patient who went through a telemedicine service may initiate a chargeback if: Additionally, because medications can be prescribed through a telemedicine session, banks and payment processors see a higher level of risk within this industry. This is why many telemedicine organizations have a hard time finding the right Payment Processing Company for their operations. they cannot go with just any popular payment service platform, as their accounts run risks of being shut down and their funds being inaccessible to them. What Can I Do For My Telemedicine Business? If you are a telemedicine provider looking to obtain a secure payment processing service, you will want to go with a company that has the background of having worked with high-risk merchants. A company that works with high-risk merchants will not put unnecessary restrictions in place for your merchant account. You will be able to operate with ease, and you may find that a company that has experience with high-risk supplement and wellness businesses can offer further solutions for your business outside of payment processing. Benefits of Working With Different Companies Dedicated to Health and Wellness Groups Because a lot of smaller industries within the health and wellness industry are considered high-risk, working with companies who specialize in this industry is key. These types of companies have the experience of having worked with high-risk merchants, and use resources to be able to provide reliable payment processing services to sellers and organizations. Some of the benefits of working with these types of companies include: Telemedicine could be considered a risky industry, but it doesn’t have to be for your organization. When you work with companies that have the background of providing services to high-risk merchants, you can be reassured of the solutions being offered to your business, as they are tailored just for your industry. Connect with Relevant Health! Are you a telemedicine provider looking to find the right payment processing service? Have you been needing to up your digital marketing efforts, as well as the design of your organization’s websites? Whatever your telemedicine practice needs, connecting with companies such as Relevant Health can be vital. Relevant Health is a dedicated company that has been helping fitness and health businesses through a variety of solutions. Get started on securing your telemedicine business and further developing it for your patience. Contact Relevant Health today!

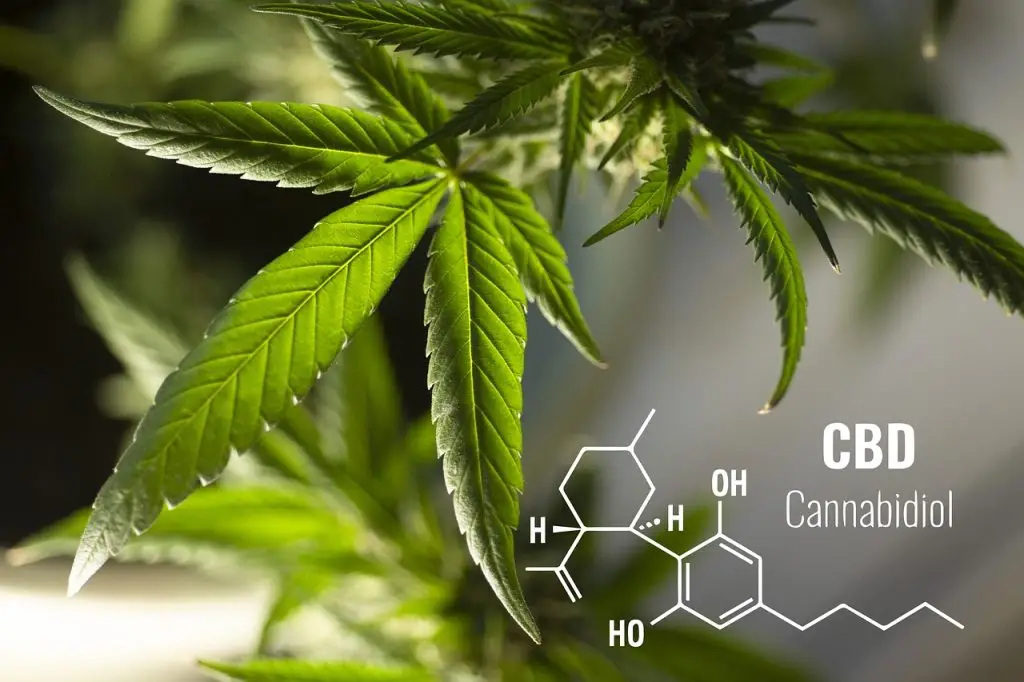

Is Square A Solid Solution For CBD Merchants?

Square is one of the most popular payment processing platforms available today. In today’s day and age, it is vital to have the most reliable payment processing solutions available for your business. As a CBD merchant, is Square the right platform for you? While it may seem appealing, Square may not be the best choice for your business. Should you use Square for your CBD business? Are there better options? We will discuss this and more. When you are confident in your payment processing, you can focus on enhancing the experience, selection, and overall quality of your business for past and future clients! Should I Use Square for My CBD Business? While other payment processing platforms restrict sales of CBD products, Square has been testing a program specifically created for CBD merchants. However, it is not as easy as simply signing up and immediately getting access to the seller tools that Square offers. There is an application process, as well as fees and regulations that CBD merchants looking to use Square must follow. Square’s Policy on CBD As a CBD seller, you must apply to the specific Square CBD program. There is a limited type of products allowed to be sold through this program, and they must not contain more than 0.3% THC. Square also bans the sale of CBD paraphernalia. On Square’s CBD program application page, the platform explicitly states that it cannot guarantee a CBD merchant’s ability to sell in the long run, as Square depends on maintaining relationships with banks and lenders. It is no secret that many banks and lenders are weary of CBD companies, as they are considered high-risk merchants. Not only is it risky to sell on Square as they do not promise to support CBD sales in the long run, but they also have higher fees for CBD merchants compared to other sellers who use Square. How Can I Successfully Process Payments for My CBD Store? While using Square for your CBD company is not impossible, you will soon realize that turning to another payment processor is better. Because of Square’s restrictions and high fees, many CBD companies are hesitant about using this platform for payments. Not to mention, there is no guarantee that your account will not suddenly be locked and your funds inaccessible if Square deems your products are breaking their CBD program policies. Suppose you are looking to successfully process payments. In that case, it is in your best interest to look for a company that has the experience of having worked with many other CBD businesses. These payment processing companies have the resources of having worked with high-risk merchants in the health or Wellness industry, and they will not reject your company or have many policies as the Square platform does. You want to make sure your clients know their payment information is being secured by a reliable payment processor, and you always want to ensure your funds are accessible to you as well. Benefits of Working With a Payment Processor Familiar with the CBD Industry Working with a payment processing company like Relevant Health which has the relevant (no pun intended) experience and resources of having worked with other CBD companies is vital for the operations of your business. Some of the benefits of working with a payment processing company familiar with the CBD industry include: Selling CBD products can be considered a “risk” by other industries, but it can be a seamless operation when you’re working with industry-specific payment processors. This is why there are so many notable benefits to working with companies that are oriented to provide the proper solutions to CBD companies and other similar businesses. Work With Relevant Health! Your CBD company sets out to connect customers with holistic and nourishing products. Your payment processor shouldn’t get in the way of this goal. While the Square platform offers a CBD program for some specific merchants, the fees and policies can eventually become an obstacle for your business. Work with a knowledgeable company like Relevant Health, that has the proper experience and tools from past work with CBD companies. Make the right choice for your business today!

Reliable Credit Card Processing for CBD

CBD has been linked to helping with symptoms of anxiety, depression, pain, and more. Building a reputable CBD company is no easy feat, but one of the key elements can involve having the right payment processor. This can make it easy for buyers to browse your site and trust their payment details are secure within a reputable site. However, how hard can it be to find a reliable credit card processor? For CBD companies, this can be an intimidating task, as some banks and lenders are instantly put off by the nature of CBD products. However, it’s important to know there are existing companies that offer the right tailored solutions for CBD merchants without any risks or problems. What does dependable credit card processing look like for your CBD business? What shouldn’t you do when it comes to a secure payment gateway for customers? Continue reading now to learn more about how to find the most dependable credit card processing for your CBD company. Why Can’t I Use Any Credit Card Processor Service For My CBD Business? There is no question that CBD is a completely legal product that many people can purchase without issue. However, because of the plant it is cultivated from, typical payment processors such as PayPal, Stripe, and Square immediately label CBD businesses as high-risk merchants. If you carry different kinds of CBD products in your online store, you will be labeled as high-risk by popular payment processing platforms. What Problems Can Occur? If you apply for a merchant account under PayPal, Square, or Stripe, you may be approved at first. However, after further looking at the CBD products you’re selling, these payment processors will instantly shut down your merchant account. This means: It’s obvious that when the payment processor you’ve chosen shuts down your merchant account, it can lead to a domino effect of consequences that affect your business. How Can I Avoid Any Problems With Payments on My Merchant Site? Don’t go through the hassle of getting your merchant account shut down by a popular payment processor. Instead, go with a company that has the credit card processing you need for your CBD business. If your merchant account has been shut down on PayPal, Square, or Stripe, you may feel hopeless. However, many different credit card processing companies have worked with high-risk merchants to grant them the perfect payment gateway for secure transactions. What Should I Look For in a Payment Processor? How do you know what the right payment processor for your CBD company looks like? There are a few different factors you should look for, such as: Working with the right payment processing company can allow your CBD company to further expand and reach a larger base of interested customers. When you have the proper payment processing for your business, you may find that you can attract new customers, increase revenue, and actively work to prevent theft and fraud in your transactions! Reassured in your merchant account and payment processing allows you to focus on other aspects of your business! What Does Relevant Health Offer? Relevant Health is a committed company dedicated to helping wellness and health businesses reach a variety of clients and complete secure payment processing. We offer merchants several solutions to make their payment gateway hassle-free and secure. You do not have to worry about your CBD merchant account being unexpectedly shut down. Our experience and resources allow us to meet the needs of CBD businesses that need dependable credit card processing and more. Reach New Heights In Your CBD Company! Your CBD business doesn’t have to go through the risks of being shut down by a payment processor. Working with companies who have completed payment processing operations for CBD sellers and other high-risk merchants will result in a variety of benefits for your business. If you are looking for credit card processing and other solutions to boost your company, contact Relevant Health today.

Why You Should Not Use Stripe, Square, or PayPal For Supplements

Stripe, Square, and PayPal have long been regarded as the payment service providers for a number of merchants and companies. However, if you are looking for a payment platform for your supplement business, it is best to avoid these platforms. By relying on any of these three, you may actually be putting your company and any funds collected at risk. Why should you avoid Stripe, Square, and PayPal for your supplement business? What are the alternatives to ensure your company has a secure and efficient payment gateway? We’ll discuss more now. Why are PayPal, Stripe, and Square Not Reliable For My Company? PayPal, Stripe, and Square are the top three payment service platforms that many companies use to collect money for products, subscriptions, and more. However, if you are looking to collect payment for your supplement products, it is crucial you avoid these platforms. This is because PayPal, Stripe, and Square do not support the sale of supplements, which means you will not be able to complete transactions and collect funds using these three payment services. This can immediately create problems with potential clients, as well as cost you a lot of money. Risks of Using These Platforms If you are considering PayPal, Stripe, or Square for transactions involving supplements, you should immediately stop. PayPal and Square both regard supplements as pharmaceuticals. While this couldn’t be further from the truth, using both platforms for supplement sales can lead to having your account immediately shut down or restricted, and putting you in danger of losing any funds that you may have acquired. Similarly, Stripe does not support the sale of dietary supplements or medical devices. Attempting to use this payment service can also bring you a load of headaches while you operate your business. Stripe, Square, and PayPal refuse to deal with supplement transactions because it would breach the contracts of the payment processors and banks they work with. Because the sale of supplements comes with some legal risks that don’t apply to selling other products, it can often be difficult to find the right payment gateway if all you are familiar with are the ‘normal’ payment service platforms. How Can I Get Secure Payment Processes For My Business? Supplement companies and other health and wellness businesses are considered high-risk merchants. Because you are not able to complete transactions using what would be the ‘traditional’ payment platforms like PayPal and others, you still have to go about picking a secure and trustworthy payment gateway for your supplement business with a specialized high-risk merchant account. This may seem intimidating, but it can actually be quite easy with the right research. There are companies that are dedicated to providing the support and proper solutions for health and fitness companies that are looking to sell supplements and other similar products. These companies should offer solutions such as fraud management, secure credit card processing, and more. Working with a payment processor company that is right for your supplement business can also mean dealing with different fees than those associated with PayPal, Square, and Stripe, which can be even more beneficial for your business. Benefits of Going with Relevant Health Relevant Health is one dedicated company that has the experience working with high-risk merchants. The CEO of Relevant Health worked as a high-risk merchant himself in the past, so using his experiences and resources, he set out to implement the necessary solutions for supplement and other wellness-related businesses. Some of the benefits that come with working with Relevant Health for your supplement business include: Do You Need Innovative Solutions For Your Supplement Business? If you’ve started your supplement business, then you are determined to bring customers nourishing products that can be preventative as well. Unfortunately, PayPal, Stripe, and Square do not support transactions with supplements. While some merchants try to use these three platforms for their supplement or wellness business, the results can be devastating to a business. Instead, focus on a specialized payment processor that is uniquely focused on businesses in your industry. Companies like Relevant Health work with supplement merchants and other similar businesses, offering unmatched solutions to better business operations and allow for smooth and secure payment transactions.

Reliable Credit Card Processing for Nutraceuticals

In today’s market, wellness and other similar health companies are interested in reaching a broad consumer base. Ensuring your products reach interested customers can be a significant accomplishment, but your payment processing platform shouldn’t get in the way of this milestone. When it comes to reliable and secure credit card processing for your nutraceutical company, you want to make sure you are working with the right processing solutions. Why does a nutraceutical company need alternate credit card processing compared to other markets? What are the benefits of working with a company that can offer you unique solutions for your health-oriented business? Read on to find out. Why Does Your Nutraceutical Company Need Alternate Payment Processing? Nutraceuticals are a broad term for defining products that fall under the wellness and preventative health categories. This product is derived from food sources with additional nutrient benefits. Hence, the name ‘nutraceuticals’ combines the terms ‘nutrient’ and ‘pharmaceutical’. Nutraceuticals have steadily grown as an industry, with 2020 seeing a 44% increase in sales during the first half of the year. The demand for nutraceuticals continues today, with many people looking for alternate solutions to obtaining necessary nutrients. What About PayPal, Stripe, or Square? While trying to meet the demand for nutraceuticals, there is something crucial to keep in mind. Popular payment platforms like PayPal, Stripe, and Square have worked for several merchants, but those in the wellness and supplement industries will want to avoid them. This is because PayPal, Stripe, and Square do not allow certain supplements to be sold, such as NMN. Attempting to sell these supplements will result in companies having their accounts shut down and funds from sales and other subscriptions locked. How Can Credit Card Processing Become Easier? Online supplement and wellness businesses are often regarded as high-risk merchants. As high-risk merchants, typical payment processing platforms are weary of working with these companies, resulting in difficulties with credit card processing and a stable payment gateway for customers. To be confident with payment processing and ensuring customers can securely provide payment, you will want to work with dedicated companies that have the experience and solutions for many health-focused companies. By working with a company that offers your business the right payment solutions, you can focus on ensuring customers are satisfied with the quality of your products and the ordering/payment process overall! Some payment processing solutions you should be looking for include chargeback management and fraud management. These two issues can instantly hinder business operations. The health and wellness industry is laden with chargeback issues, so having a solution for chargeback management can provide a great deal of help in the long run. Additionally, fraudulent payments are a risk that many companies encounter in various industries. Health and wellness businesses in particular should always be keeping efficient fraud management solutions in mind as they navigate through everyday transactions. Benefits of Efficient Credit Card Processing for Nutraceuticals How can your nutraceutical business continue to further excel with reliable credit card processing solutions? Benefits of efficient credit card processing for your business include: As your nutraceutical business grows, you want its payment processes to be hassle-free. This can benefit both your company and your clients. Not to mention, you will not have to worry about the risk of having your company’s funds suddenly locked up and your account shut down, as some high-risk merchants who have worked with PayPal and other payment platforms have had happen to them. Don’t put your company at risk. Work with expert companies who have the proper solutions specifically tailored to fit your needs. Relevant Health is the Solution! In today’s modern age, there are several solutions to ensure companies process payments for products, subscriptions, and more through safe and reliable methods. Nutraceutical companies offer customers many nutrient-rich and nourishing products, so why wouldn’t you want your own nutraceutical company to have the most innovative payment solutions? Working with a company that helps high-risk merchants with reliable credit card processing and more is key. Relevant Health is dedicated to helping health and wellness companies make their operations secure and efficient. Keep your nutraceutical company up to date with secure credit card processing and other revolutionary solutions. Book your consultation with us today.